1

/

of

1

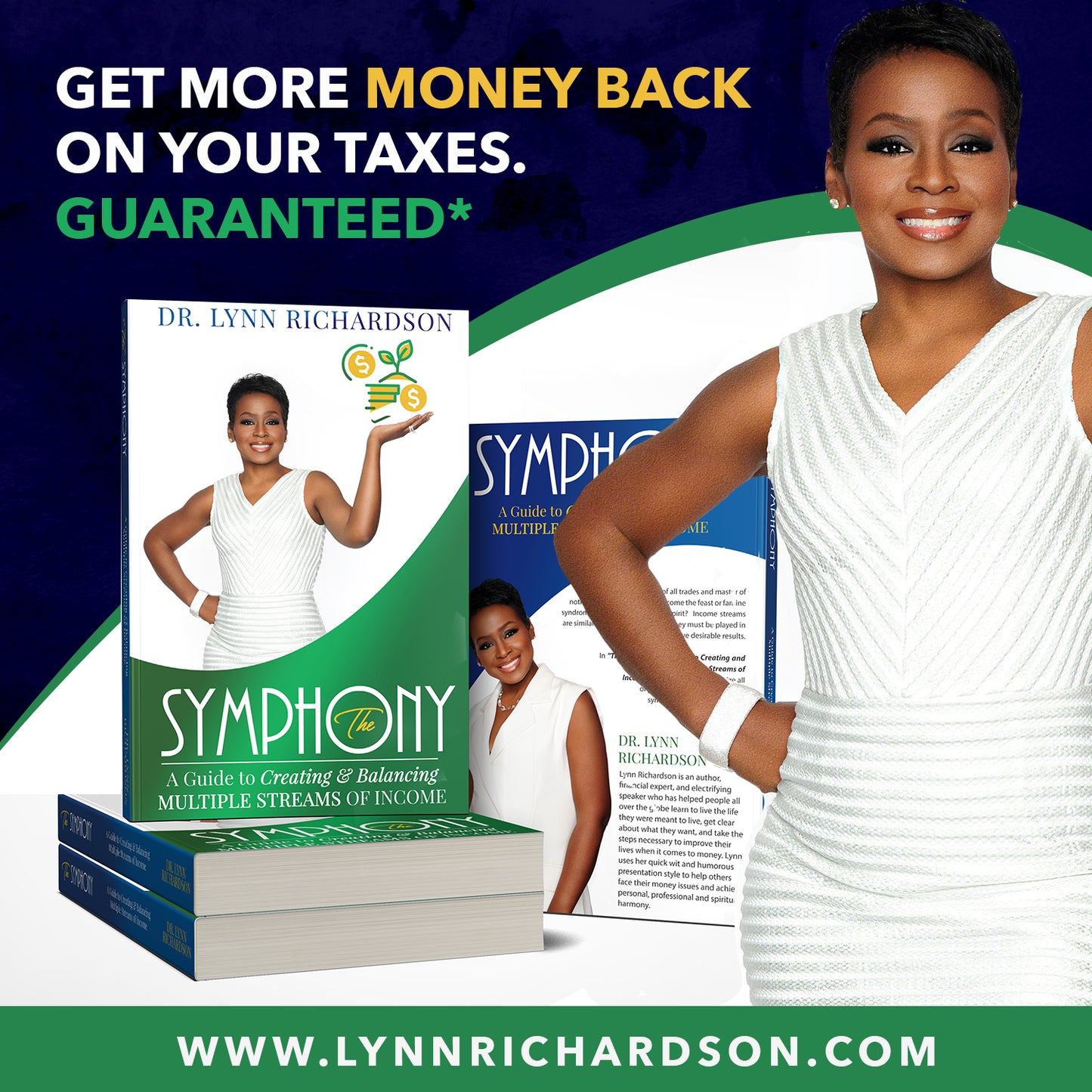

Wealth University

Tax Reduction, Planning & Coaching Consultation

Tax Reduction, Planning & Coaching Consultation

Regular price

$ 199.00 USD

Regular price

Sale price

$ 199.00 USD

Unit price

/

per

Shipping calculated at checkout.

Couldn't load pickup availability

- Get the Assistance of Richardson Financial Group Tax Reduction & Planning Service. In addition to sending, you a copy of my game-changing book The Symphony: A Guide to Creating and Balancing Multiple Streams of Income, we will do the following:

- Review your tax return to determine your missing tax deductions. Missing deductions range from $30,000 on the low end to hundreds of thousands on the high end.

- Help you set up your expenses each month and assign them to the right business category.

- Provide you with the proper paperwork you need to support your business endeavors (for example, hiring your kids to work in your homebased business, budgeting journal which also serves as a diary, etc.)

- Help you submit your spreadsheet to your tax preparer so they will have few questions, if any like we've done for so many others.

The discounted consultation fee is $199; this is a written assessment with a live Q&A. I will conduct a thorough analysis of your homebased business, your monthly expenses and your previous two tax returns to determine your missing tax deductions.

THIS IS INCLUDED in the Entrepreneurs Academy, Platinum and Diamond programs: https://www.lynnrichardson.com/collections/all-inclusive-coaching-programs

After your payment is submitted, you will receive a confirmation email with a link to submit your documentation and schedule delivery of your written assessment, SO PLEASE MAKE SURE YOU TYPE THE CORRECT EMAIL ADDRESS and check your mailbox/spam for an email from shop@newwealthuniversity.info.

Share